What is forex trading?

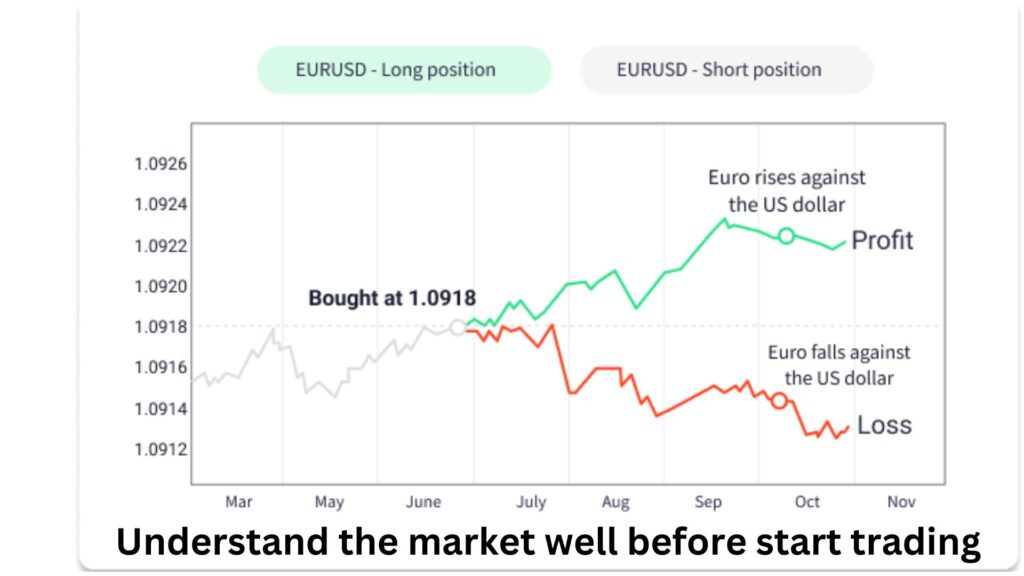

Forex trading is an activity involving the exchange of currencies between buyers and sellers at a rate set by the market. If you have ever traveled abroad, you have almost made a forex transaction.

Currencies are traded in pairs. For example, the GBP/USD pair is at 1.20. As a result, one GBP is equal to $1.20. The quote currency (or counter currency) appears after the base currency.

Forex trading is done to make a profit. The price movements of some currencies can be volatile. This volatility is what makes forex so appealing to traders. It increases the possibility of high profits while also increasing the risk.

How does forex trading work?

- It’s buying and selling foreign currencies.

- Most transactions are through brokers.

- Online trading allows you to profit from forex price movements through derivatives.

- Leveraged products allow you to open a position for a fraction of the full trade value. They can boost your earnings, but if the market goes against you, they can also boost your losses.

Why do most traders lose money in forex trading?

Forex is the largest financial market in the world and more than $5 trillion is traded daily in this market.

While there are many forex investors, only a few are successful. Certain mistakes as follows can prevent traders from reaching their investment objectives:

Trading psychology

- It’s an important aspect of trading, and most people are not mentally prepared for it.

- When money is at stake, fear, greed, and other emotions make trading difficult.

- Before trading, you must know your risk. Understand the emotional aspects of trading.

- A successful forex trader will experience many little losses and a few large profits.

- Many losses in a row can be draining and put a trader’s endurance and confidence to the test.

- Most traders could not accept the losses. They re-enter the market anticipating the market will reverse to recover the losses.

Low capital

- Traders begin forex trading to make quick money or to pay off debt.

- Many traders believe they can make a huge profit from a small capital.

- These traders may trade against trends and lose money.

- Brokers encourage traders to use higher leverage and lot sizes with small capital.

- High leverage, low capital, and wrong trading timing increase risk resulting in losses. As a result, traders become very emotional.

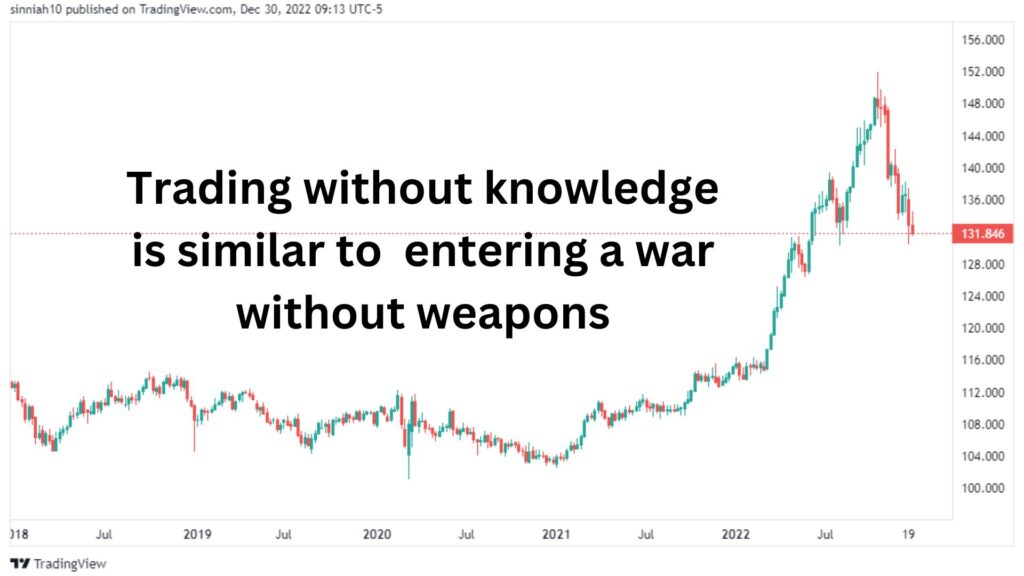

Knowledge

It will be a disaster to enter a war without preparations and weapons. Most new traders enter the forex trading market without proper preparation. They lack forex trading knowledge such as:

- Lack of technical and analytical knowledge.

- Lack of fundamental and analytical knowledge, news, and sentiments.

- Many traders try to profit by trial and error. This approach could be very expansive.

- They suffer losses and devastate their accounts without proper knowledge of the industry.

- To be successful, they should learn from successful traders.

Trading Methodology

- Traders tend to fail if they do not have a proven trading method or strategy.

- After a string of losses, they will decide to quit the game.

- But they don’t realize there is still hope. Right education, a workable method, psychological balance, and persistence are key to success.

- Experiment with different currency pairs, trading sessions, time frames, and indicators. This will help to determine which one works best for you.

- Create your trading system and back-test it to see if it’s profitable.

- Fine-tune your strategy to maximize profits. This may take some time, but using a trading method you trust can help you reduce stress while trading.

- Successful traders use a written strategy that incorporates risk management guidelines and details.

- With a strategic trading plan, traders can avoid some of the most common trading mistakes. If you don’t have a plan, you’re limiting your potential in the forex market.

Risk management

- A novice trader puts 10% or more of her trading account at risk in a single trade.

- This is an area that needs attention. You should focus on the trading process not on making a profit.

- Experienced traders focus on managing risk before thinking about profits. They understand how to calculate the size of their position. They do not accept trades that need them to take excessive risks.

- This help to keep their heads and make rational decisions even if they have a string of losing trades.

Forex system

- Many forex trading systems advertised online promise huge profits.

- Some traders put money into these automated systems and then lose money.

- New traders should understand that no automated systems for profit trading in forex.

- They should develop their method and strategy after learning about the forex market.

Cannot accept the mistake

- Most people could not accept their mistakes.

- They continue trading in the same way expecting luck to play its part for them to turn the table. They continue to waste resources with their mistakes.

Forex trading winning tips

The forex market has its distinct characteristics. Traders must learn these characteristics through time, practice, and study to trade them. Traders will do well to remember the following helpful forex trading tips:

- Take note of the pivot levels.

- Trade with a competitive advantage

- Keep your trading capital safe.

- Simplify your market research

- Set your stop loss point upon calculating based on money and risk management

Conclusion

Most retail traders do not profit from trading. Low or no leverage, low risk, and effective trading strategy help to increase success. Besides, with well-organized plans and discipline, your success rate improves over time.