What is Autotrading?

Making decisions regarding when to enter and leave deals is the most difficult aspect of investing. These days, Autotrading systems can be used to do this. Autotrading is a type of investing where software is used to enter and exit the market.

The program will utilize algorithms to place trading orders and manage your investments; the trader needs to adopt a proper trading strategy based on fundamental market analysis. Continue reading this thorough article if you want to learn more about automated trading, and the advantages, and disadvantages of using the system.

Trading that is automated is an intelligent approach to reduce the amount of work required for manual trading. For instance, you don’t have to constantly check the market.

How does Autotrading work?

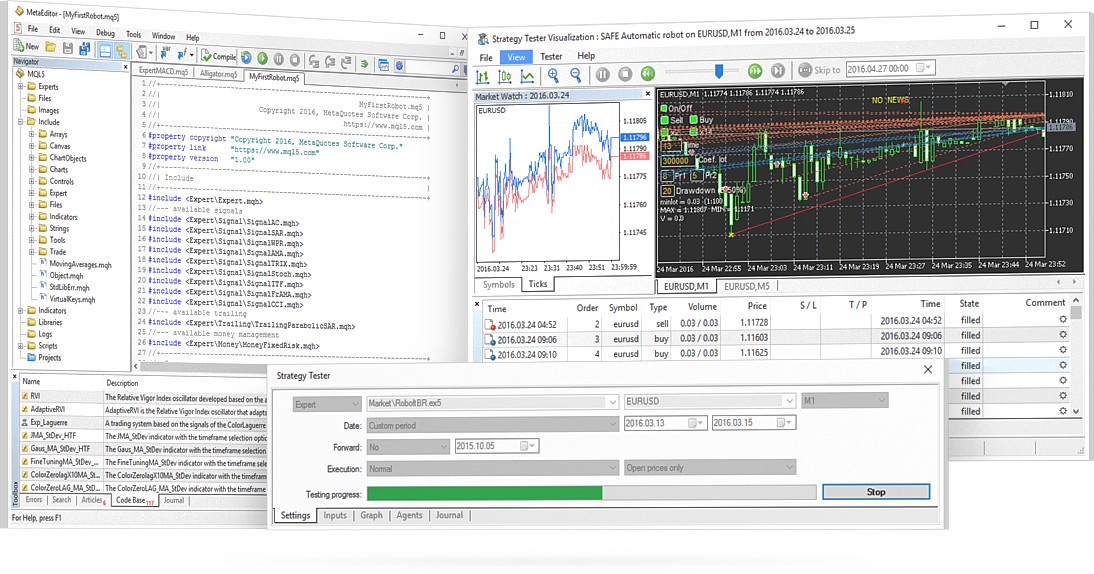

You will first select a platform and establish the specifics of your trading strategy. Your algorithm will employ the rules and conditions you develop based on your trading experience to execute trades on your behalf.

The timing of the deal, the price at which it should be opened and closed, and the numbers are typically the deciding considerations. Buy 10 shares of Google, for instance, when its 50-day moving average surpasses its 200-day moving average.

The defined automated trading method will continuously track price movements on the financial markets, and if certain criteria are satisfied, trades will be carried out automatically. The goal is to execute trades more quickly and effectively while taking advantage of particular, technical market developments.

Advantages and disadvantages of the Autotrading

Autotrading is the foundation of the modern trading period. Nearly the majority of the world’s professional traders use Autotrading to trade forex or cryptocurrency.

Trades can be entered and exited according to precise rules that, once programmed, can be carried out automatically by a computer using automated trading systems. Depending on the individual criteria, any orders for protective trailing stops and profit goals will be immediately generated as soon as a trade is entered.

Although there are a few drawbacks associated with the system, it offers traders a number of benefits. Some of them include:

Advantages

- Diversifying trades

- Adjust your strategy to fit your timetable and have transactions executed automatically day or night.

- With deliberate action, you can lessen the impact of your feelings and instincts.

- Discover new opportunities and evaluate trends using a variety of metrics.

- Execute numerous real-time deals at once and do away with manual execution

- Pre-programmed instructions are typically based on a strategy created using technical analysis and several risk management techniques.

- Testing trading strategies can be done by backtesting the automated system using a set of rules against the past data in a short time. Before employing the system to make trades, backtesting enables us to tweak the system’s settings until it achieves its maximum gain potential and tolerable risk against the gain.

- Enhancing profitability through asset diversification and accelerated execution speed.

Disadvantages

- Using APIs, automated trading software executes deals, enabling them to operate algorithmically and without human input. If they encounter any mechanical problem, such as poor network connectivity or interrupted power supply, they frequently begin to malfunction. Additionally, there can be security flaws because not all software suppliers would use the more secure server.

- Market manipulation by major players and other factors can all have an impact on the forex or cryptocurrency market. Most of these events are difficult to foresee. As a result, bots can’t properly consider these events.

- Avoid over-optimization. Modifying a trade strategy’s functionality to increase the return on every dollar invested is known as over-optimization. Changing a strategy, for instance, to get unexpected outcomes on the historical statistical data that it was tested on may have an impact on the results.

- Be aware that scam bots are now pervasive in the forex and cryptocurrency market. All of them are specifically aimed at individual traders.

Is Autotrading system reliable?

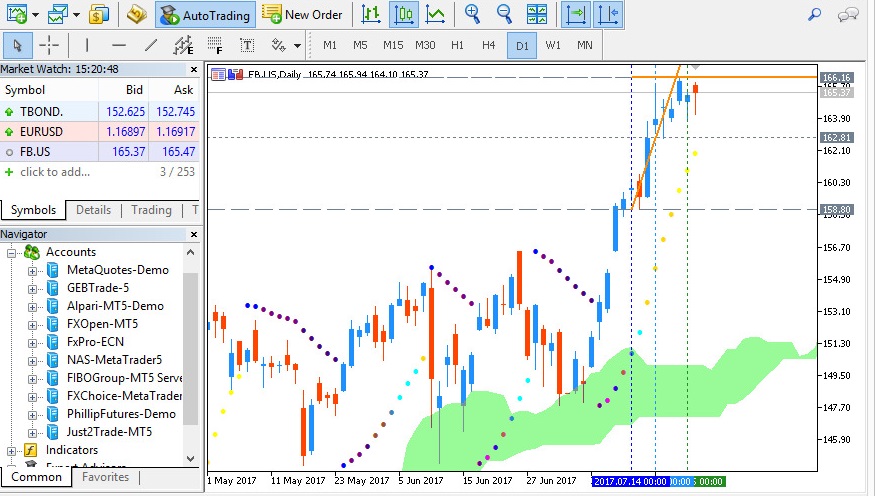

All available Autotrading systems software has different features and services. For instance, while some are built for the forex market, others offer automatic trading for the cryptocurrency market. The qualities of effective automated trading software are as follows:

- The platform you use should be an Autotrading one that provides services for all the markets you are interested in.

- The operating system must be simple to use.

- The majority of platforms provide free trials before purchasing.

- Nothing speaks more to the dependability of the software than user testimonials.

- Before entering any personal information or starting your investment, be sure to carefully read the evaluations regarding the software you are signing up with.

Protections

Forex and cryptocurrency Autotrading bots can be successful, but you shouldn’t count on them to be profitable always. They are not a system that prints money. Instead, they can assist you in improving your market analysis and automating the challenging aspects of investing, such as setting up trade parameters.

Therefore, you must make sure the bot complies with your requirements before automating your trading model. For instance, research the supported exchange’s history if you require a safe bot that prioritizes long-term investing.

Other factors include long-term investments vs. short-term trading, minimum deposits, and withdrawals allowed by the exchange, time of trading, and your account’s balance.

The above factors must be checked before beginning your automation journey.

If you purchase an automated trading bot, please ensure that you have considered the following factors:

- Safety and Security

- Free trial

- Efficiency

- Reliable supplier

- Performance of the bot

Conclusion

Platforms for automated trading might be a good approach to automate your trade and make the most money. However, if you are unfamiliar with the forex and cryptocurrency market or lack a successful trading technique, they may be risky. To prevent any significant losses, it is crucial that you learn how to employ Autotrading bots and methods.