Everyone dreams to be rich

Are crypto trading bots money-making machines? People are very creative and invent various tools or machines that help to make money for them.

You would have read that rich people don’t work hard but money flows to them while sleeping. They make money while sleeping and while having a holiday. There are a lot of people that enter the cryptocurrency market searching for a quick method to get rich. Automated crypto trading bots make money for them. They only need to fix the specific algorithm and formula for the machine to run and make money.

What are crypto trading bots?

Bots are computer programs that trade on your behalf when trading cryptocurrencies. The most well-known cryptocurrency bot services feature proprietary algorithms that can be customized to match particular needs or preferences.

Certain cryptocurrency bot services could need monthly membership instead of transaction fees depending on your preferences and needs. Even without knowing how to code, you can create an account with several crypto bot providers.

How do the crypto trading bots work?

The bots work according to the trades’ specific rules but can be modified to suit your requirements. Trading bots can trade continuously for 24 hours, something no human can accomplish is what makes them so impressive.

Some bots stand out from the crowd thanks to unique characteristics. In addition to trading, this helps you automatically purchase and hold cryptos by doing so at a discount. It is up to you to determine which cryptos you want and which bot will assist you in obtaining them.

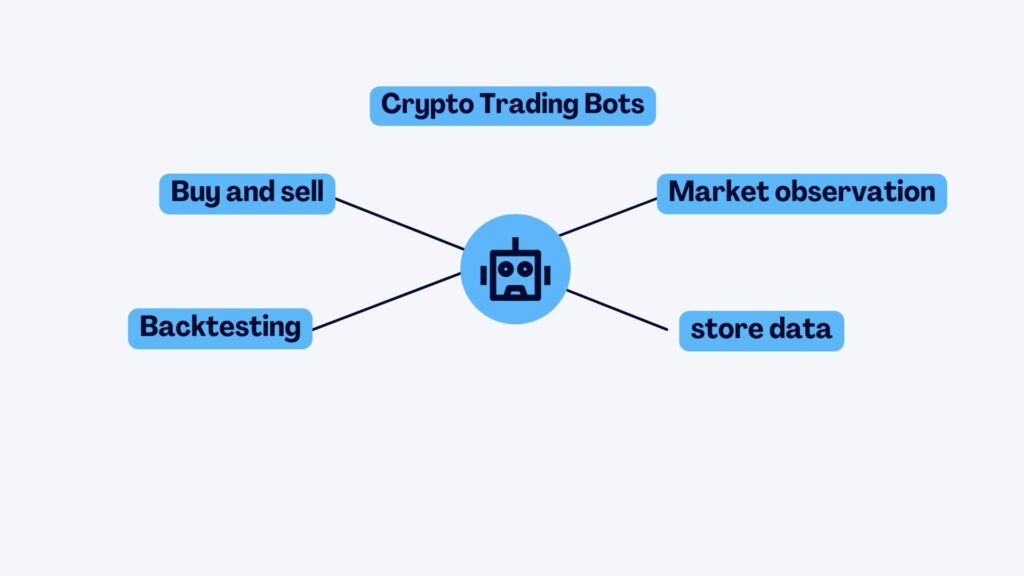

Most crypto trading bots have the following abilities:

- Market data analysis

- Market risk analysis and prediction

- Buy and sell assets

Stages of processes of best crypto trading bots:

- As part of the notification generation process, the bots anticipate and detect potential swaps based on market movements and, frequently, technical indicators.

- The process where the crypto trading bot assigns risk based on the user’s specifications is called the risk allocation Step. The capital sum of money allocated in a transaction is determined by these accepted standards.

- The real buying and selling of cryptocurrencies take place during the execution phase.

Make sure the program can handle both simple and difficult tasks if you want your bot to operate at its best. Any crypto trading bot must have the following features:

- Market observation and documentation

- Ability to carry out a specific strategy, which should be adaptable and changed depending on the suitability of the algorithm.

- Organizer

- Backtesting

- Registration, storage, and retrieval of transaction data

- Security

Pros and cons of using crypto trading bots

Pros

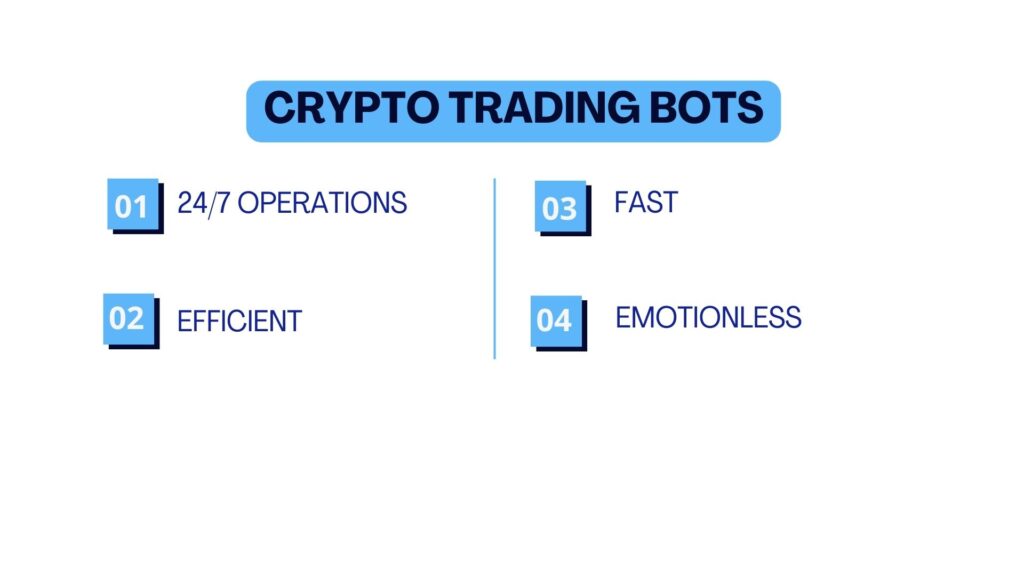

Emotionless brings clarity

Cryptocurrencies are very volatile. So, traders would get panic or be overconfident very fast. Decisions made under the influence of emotion can eventually result in a wrong judgment and poor decisions.

Efficient

Crypto trading bots can analyze and trade various cryptos while still making trades.

Fast response

When the cryptocurrency market is extremely unpredictable, taking too long to complete a trade can be a major issue because you risk missing out on the opportunity.

However, because crypto trading bots place orders immediately, there is a significantly lower chance of losing money due to uncertainty.

24/7 operations

While you sleep, crypto trading bots work around the clock, seven days a week, making potentially profitable decisions for you. They won’t ever miss good opportunities.

Cons

Supervise regularly

Even though it’s automated, the crypto trading bot needs to be monitored regularly. There may be some bugs in the system that may affect the bot’s operation.

Security concern

Trading bots use APIs to execute trades. The APIs enable the bots to operate automatically without requiring user input.

Cybercriminals may target crypto trading bots. By turning off automatic withdrawals and keeping your API keys private, you can lower your risks of attack by cybercriminals.

How to choose the best crypto trading bots?

Credibility

You are trusting the trading bot. But behind the scene is the team that builds the bot and they must be reliable and experienced. An easy checklist can be used to accomplish this:

- The team’s work experience

- Their credentials

- Have they ever managed to build and maintain a solid portfolio?

- How well-documented is the bot’s functionality?

- From whence do they obtain their fund?

Strategy

It is imperative to know which bot best fits your selected strategy. This is the reason you should visit the bot’s website and read the various reviews and how-to articles that have been written about it.

In light of that, you should also be aware of how involved you should be in the configuration of the bot.

It won’t make sense for you to subscribe to a bot that demands its users to be more hands-on if you aren’t that technologically minded.

Support level

The support level provided by the staff is important. Other factors include:

- Is it simple to contact the staff with inquiries about general support or bugs?

- Does the business have a vibrant community on its website or social sites and whether the interaction is taking place in the community?

- Do the developers offer prompt updates and fixes for any potential bugs?

Cost

You should compare the price of the bot with other reliable vendors’ prices and monthly charges. Although it should go without saying that a paid bot will typically offer better service than a free one, you should carefully consider the advantages and disadvantages before hiring it.

Market condition

Each bot will carry out a plan in a special way. Therefore, if you prefer a particular strategy, you must determine whether the bot can execute it successfully or not in different market conditions. You don’t want to blow a possible investment opportunity by executing your strategy poorly.

Easy to use

You have to ensure the trading bot is user-friendly. Because of this, be sure the bot you select is appropriate for your level of experience. Choose a bot that is simple to use and may not have many fancy features if you are just getting started.

Conclusion

Crypto trading bots are popular in the cryptocurrency market due to their many benefits. This resulted in the creation of thousands of automated bots, which made it difficult to select the best choice. Since they require almost no technical expertise, a cryptocurrency trading bot must take into account advantageous qualities. The above guide will assist users in employing automated crypto trading bots to trade cryptocurrency like an expert.

Human emotions have a significantly reduced impact on cryptocurrency trade decisions, resulting in profitable trades. It’s crucial to keep in mind that using bots to trade and invest still entails a risk of loss because they cannot ensure success.

Disclaimer: You should not regard any of this blog’s content as advice of any kind since the information on this page does not represent investment advice, financial advice, trading advice, or any other kind of advice. Do your research before making any investment decisions.